Government Employees

Government employees in Khyber Pakhtunkhwa (KP) have access to a variety of financial advances to support their personal, professional, and family needs. These advances are designed to provide financial assistance for housing, vehicles, education, medical emergencies, and personal needs, ensuring that employees can maintain financial stability and meet their obligations without undue stress. This guide provides a comprehensive overview of the available advances, eligibility criteria, required documents, and application processes.

Overview of Advances for Government Employees

The advances for government employees in KP are financial aids provided by the government to help employees manage various financial needs. These advances are typically offered at lower interest rates compared to commercial loans, and in some cases, they may even be interest-free. The goal is to support government employees in maintaining a decent standard of living and addressing unforeseen expenses.

BISP 8171 Result Check Online In 2024

Quick Table: Key Details

| Type of Advance | Purpose | Eligibility | Required Documents |

|---|---|---|---|

| Personal Loan | General personal expenses | Permanent employees with a minimum service period | Proof of identity, employment certificate, income certificate, etc. |

| Housing Loan | Purchase or renovation of a house | Employees with sufficient service tenure and creditworthiness | Property documents, proof of identity, employment certificate, income certificate, etc. |

| Vehicle Loan | Purchase of a vehicle | Permanent employees with a good credit history | Vehicle quotation, proof of identity, employment certificate, income certificate, etc. |

| Medical Advance | Medical emergencies | Employees with verified medical needs | Medical bills, proof of identity, employment certificate, etc. |

| Education Advance | Education-related expenses | Employees with children in educational institutions | Proof of enrollment, proof of identity, employment certificate, income certificate, etc. |

Types of Advances Available

Personal Loans

Personal loans are designed to cover general personal expenses, such as home improvements, weddings, or other significant financial needs. These loans offer flexibility in terms of usage and are typically easy to apply for.

Housing Loans

Housing loans are provided to employees for the purchase, construction, or renovation of a house. These loans usually come with favorable terms and longer repayment periods to ease the financial burden on employees.

Vehicle Loans

Vehicle loans help employees purchase new or used vehicles. These loans are particularly useful for employees who need reliable transportation for commuting to work or managing family needs.

Medical Advances

Medical advances are provided to cover medical emergencies and related expenses. These advances ensure that employees do not face financial difficulties during health crises.

Education Advances

Education advances support employees in covering educational expenses for their children. This can include tuition fees, books, and other related costs.

BISP 8171 Result Check Online In 2024

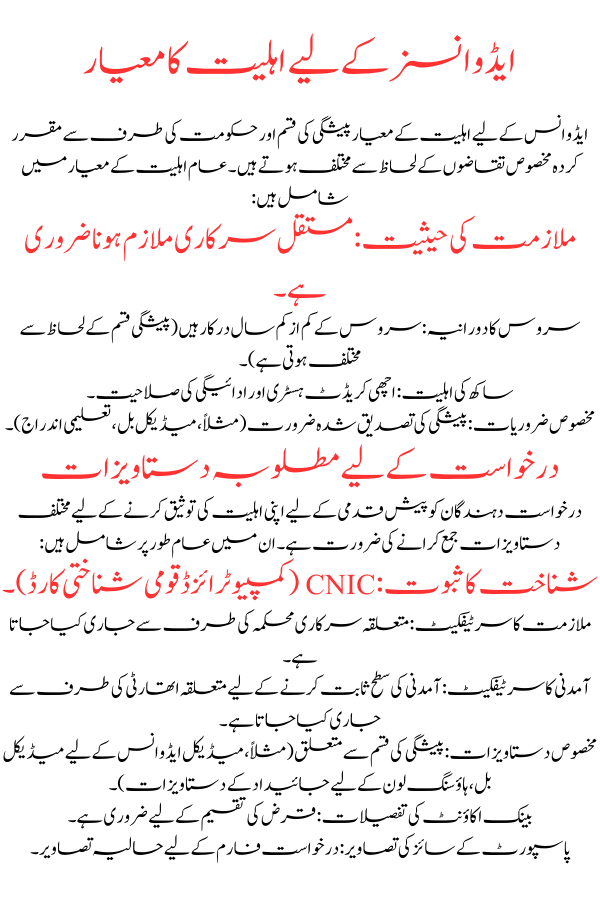

Eligibility Criteria for Advances

Eligibility criteria for advances vary depending on the type of advance and the specific requirements set by the government. Common eligibility criteria include:

- Employment Status: Must be a permanent government employee.

- Service Period: Minimum years of service required (varies by advance type).

- Creditworthiness: Good credit history and repayment capacity.

- Specific Needs: Verified need for the advance (e.g., medical bills, education enrollment).

Required Documents for Application

Applicants need to submit various documents to validate their eligibility for advances. These typically include:

- Proof of Identity: CNIC (Computerized National Identity Card).

- Employment Certificate: Issued by the relevant government department.

- Income Certificate: Issued by the relevant authority to prove income level.

- Specific Documents: Related to the type of advance (e.g., medical bills for medical advances, property documents for housing loans).

- Bank Account Details: Necessary for loan disbursement.

- Passport-sized Photographs: Recent photographs for the application form.

Application Process

The application process for advances can be completed either online or offline. Here’s a detailed guide for both methods.

Online Application Steps

- Visit the Official Website: Access the official website of the government’s financial department.

- Register or Login: Create an account if you’re a new user or log in with existing credentials.

- Fill Out the Application Form: Enter all required details accurately, including personal information, employment details, and the type of advance.

- Upload Required Documents: Scan and upload necessary documents as specified.

- Submit the Application: Review all entered information and submit the application.

- Acknowledgment: An acknowledgment receipt or reference number will be generated upon successful submission. Save this for future reference.

Offline Application Steps

- Visit Local Government Office: Go to the nearest government office handling the advance applications.

- Collect the Application Form: Obtain the application form for the specific advance.

- Fill Out the Form: Complete the form with accurate information.

- Attach Required Documents: Attach photocopies of the required documents.

- Submit the Form: Submit the filled form and documents to the office staff.

- Receive Acknowledgment: Get an acknowledgment slip or receipt as proof of submission.

BISP 8171 Result Check Online In 2024

FAQs

- How do I apply for an advance?

- You can apply online through the official website or offline by visiting local government offices.

- What documents are required for the application?

- Required documents include proof of identity, employment certificate, income certificate, and specific documents related to the type of advance.

- Am I eligible for these advances?

- Eligibility depends on factors like employment status, service period, creditworthiness, and specific needs.

- Where can I find the application form?

- Application forms are available on the official portal or at local government offices.

- Can I track my application status online?

- Yes, you can track the status online by logging into the portal and entering your reference number.

- What is the maximum amount I can get as an advance?

- The amount varies depending on the type of advance and eligibility. Check specific scheme details for exact amounts.

- Is there a deadline for applying?

- Each advance type may have its own deadlines. Stay updated with official announcements.

- What if my application is rejected?

- If your application is rejected, review the reasons provided and rectify any issues. You may reapply if corrections are possible.

- How long does it take to process the application?

- Processing times vary. Typically, it can take a few weeks to several months. Check the scheme guidelines for specific timelines.

- Who can I contact for help with my application?

- For assistance, contact the helpline number provided on the official website or visit the local government office.